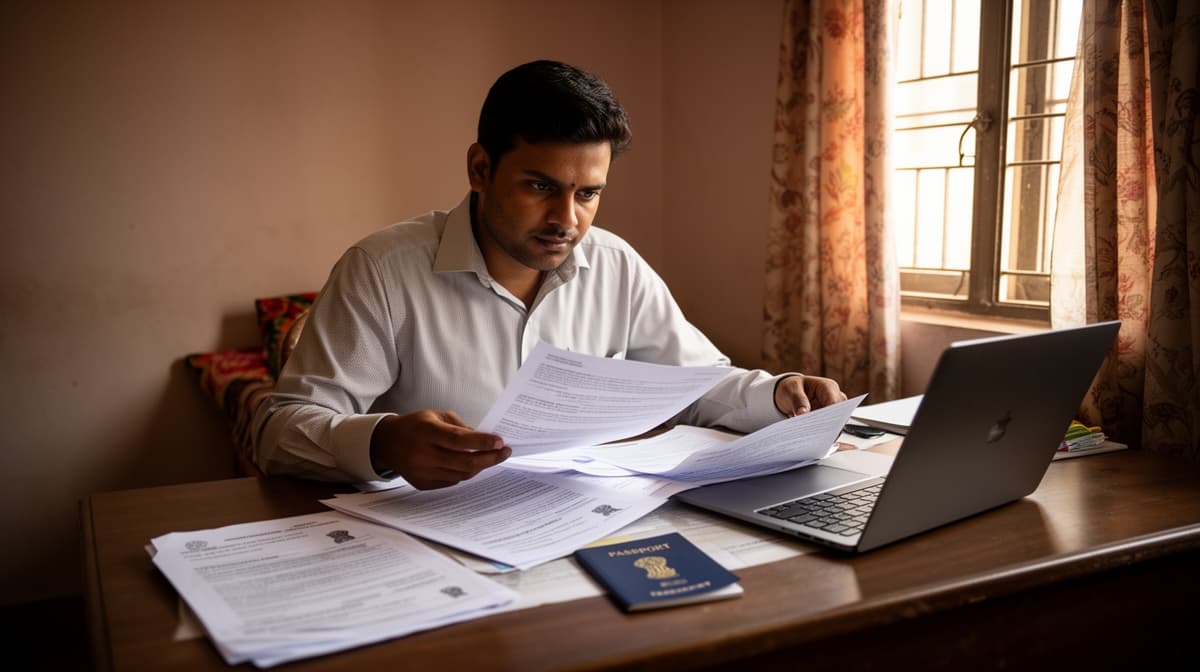

Passport Renewal Cannot Be Denied Solely On Basis Of Adverse Police Report | Article 21 And Natural Justice : High Court of Kerala

Kerala High Court holds that adverse police reports alone cannot justify denial of passport renewal; procedural fairness and presumption of innocence must prevail.