The Rajasthan High Court has reaffirmed that procedural fairness under Section 91 of the Rajasthan Land Revenue Act, 1956 is not merely directory but mandatory before any dispossession action. The judgment underscores that even patta holders are entitled to a reasonable opportunity of hearing and that administrative authorities cannot bypass due process under the guise of urgency.

Background & Facts

The Dispute

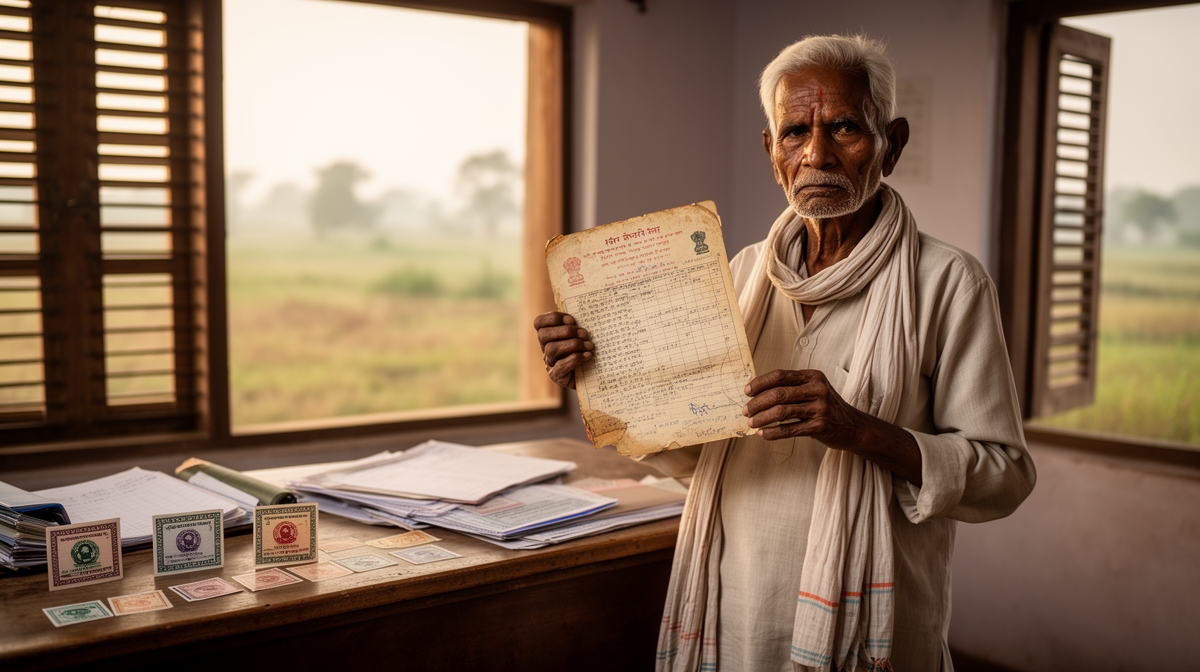

The petitioner, Hakim Mohammed, held a patta issued on 30.10.2017 for land in Kotri, Bhilwara. Despite this legal entitlement, the Tehsildar (Respondent No. 3) issued a show-cause notice under Section 91 of the Rajasthan Land Revenue Act, 1956 on 03.12.2025, alleging unauthorized occupation. The petitioner contended that the proceedings were being conducted in a hasty manner, without proper consideration of his reply.

Procedural History

The dispute escalated through the following stages:

- 30.10.2017: Patta issued to the petitioner and his predecessor

- 03.12.2025: Show-cause notice issued under Section 91

- 2026: Petitioner filed a reply, but proceedings continued without adequate hearing

- 03.02.2026: Writ petition filed seeking interim protection and fair adjudication

Relief Sought

The petitioner prayed for:

- A direction to the Tehsildar to decide the proceedings after providing a reasonable opportunity of hearing

- An interim order restraining dispossession until final adjudication

The Legal Issue

The central question was whether Section 91 of the Rajasthan Land Revenue Act, 1956 permits authorities to proceed with dispossession without affording the patta holder a reasonable opportunity of hearing, particularly when the land is held under a valid patta.

Arguments Presented

For the Petitioner

The petitioner’s counsel argued that:

- The patta issued in 2017 conferred a legal right to possession, which could not be extinguished without due process

- The principles of natural justice mandated a fair hearing before any adverse action

- The Tehsildar’s haste in proceeding without considering the petitioner’s reply violated procedural fairness

- Reliance was placed on Maneka Gandhi v. Union of India to emphasize that due process is a constitutional imperative

For the Respondents

The respondents did not appear to contest the petition, leaving the court to adjudicate based on the petitioner’s submissions and the statutory framework.

The Court's Analysis

The Court examined the interplay between Section 91 of the Rajasthan Land Revenue Act, 1956 and the principles of natural justice. Key observations included:

-

Statutory Interpretation: The Court held that Section 91 does not confer unbridled power to dispossess. It read the provision harmoniously with Article 14 and 21 of the Constitution, which guarantee procedural fairness.

-

Patta as a Legal Right: The Court noted that a patta is not a mere administrative document but a legal entitlement that cannot be extinguished without following due process. It observed:

"A patta holder is entitled to a reasonable opportunity to present his case before any action is taken under Section 91. The authority must consider the reply filed by the patta holder and cannot proceed in a mechanical manner."

-

Natural Justice: The Court reiterated that audi alteram partem (hear the other side) is a fundamental principle of administrative law. It held that the Tehsildar’s failure to provide a reasonable opportunity of hearing rendered the proceedings vitiated in law.

-

Interim Protection: The Court directed that no coercive action be taken against the petitioner until the proceedings were finally adjudicated, emphasizing that dispossession without due process would cause irreparable harm.

The Verdict

The writ petition was disposed of with the following directions:

- The Tehsildar (Respondent No. 3) must decide the proceedings within four weeks from the receipt of the order, after providing a reasonable opportunity of hearing to the petitioner

- No coercive action shall be taken against the petitioner until the final adjudication

- The proceedings must be conducted strictly in accordance with law, ensuring compliance with procedural fairness

What This Means For Similar Cases

Procedural Fairness Is Non-Negotiable

The judgment reinforces that Section 91 of the Rajasthan Land Revenue Act, 1956 cannot be invoked arbitrarily. Practitioners should note:

- Authorities must provide a reasonable opportunity of hearing before proceeding under Section 91

- Patta holders are entitled to due process, and any deviation will render the proceedings void ab initio

- Interim protection against dispossession can be sought where procedural lapses are evident

The Burden Shifts to Authorities

The onus is now on revenue authorities to:

- Document compliance with procedural requirements, including hearing notices and consideration of replies

- Avoid hasty adjudication, particularly where pattas or other legal entitlements are involved

- Ensure transparency in proceedings to prevent judicial intervention

A Precedent for Challenging Arbitrary Actions

This judgment provides a strong precedent for challenging arbitrary actions under land revenue laws. Key takeaways include:

- Writ jurisdiction can be invoked to enforce procedural fairness

- Interim relief is available where dispossession is imminent without due process

- Natural justice principles apply even in administrative proceedings under the Rajasthan Land Revenue Act