The Rajasthan High Court has reaffirmed that procedural fairness under the principle of natural justice is non-negotiable even in revenue proceedings. In a decisive order, the Court halted coercive dispossession of landholders pending adjudication under Section 91 of the Rajasthan Land Revenue Act, 1956, emphasizing that possession backed by a Patta cannot be disturbed without due process.

Background & Facts

The Dispute

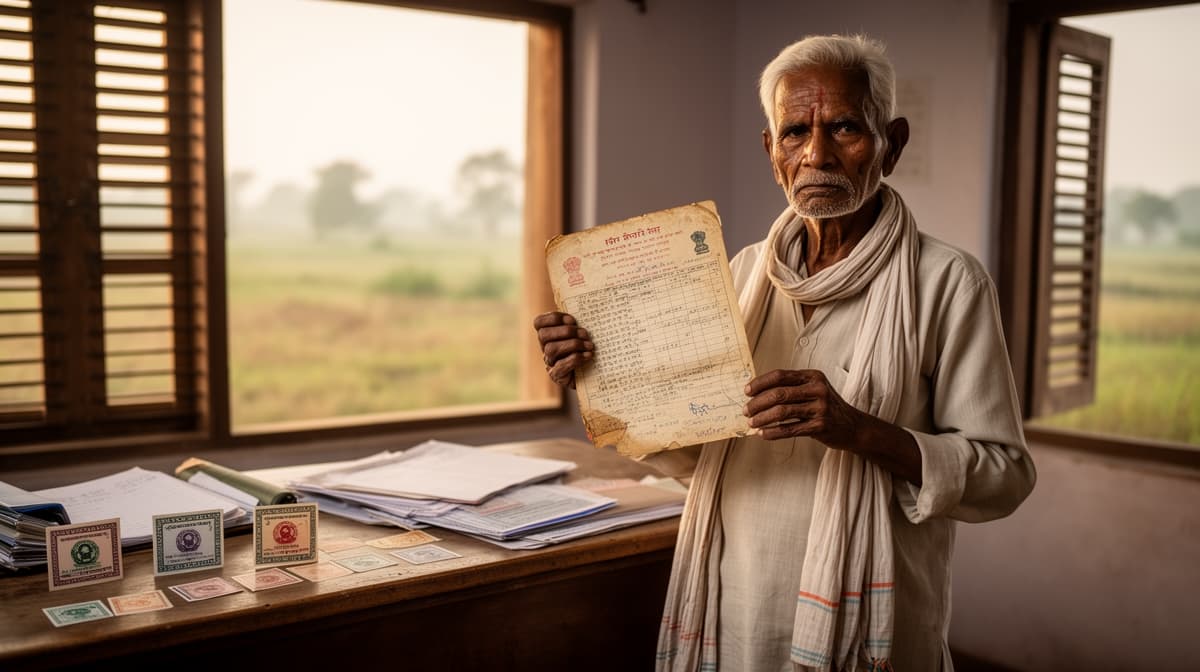

The petitioners, Manju Kumari and Praveen Vyas, are lawful possessors of agricultural land in Kotri, Bhilwara, based on a Patta issued to them and their predecessor on 20 January 2018. Despite this documented title, the Tehsildar of Kotri issued a show cause notice on 3 December 2025 under Section 91 of the Rajasthan Land Revenue Act, 1956, seeking to initiate proceedings for potential recovery of land on grounds of alleged irregularity in possession.

Procedural History

- The petitioners submitted a detailed written reply to the show cause notice, asserting their lawful possession through the Patta.

- The Tehsildar, without considering the reply or affording a personal hearing, proceeded to initiate coercive action.

- Fearing imminent dispossession, the petitioners filed a writ petition before the High Court seeking interim protection and direction for fair adjudication.

Relief Sought

The petitioners sought a stay on any coercive action and directed the Tehsildar to decide the proceedings after providing a reasonable opportunity of hearing and duly considering their reply.

The Legal Issue

The central question was whether the authority under Section 91 of the Rajasthan Land Revenue Act, 1956 may initiate proceedings leading to dispossession without affording the landholder a reasonable opportunity of hearing, particularly when possession is supported by a valid Patta.

Arguments Presented

For the Petitioner

Learned counsel for the petitioners relied on the foundational principle of natural justice, particularly the rule audi alteram partem, arguing that the issuance of a show cause notice without considering the reply or holding a hearing amounted to a violation of Article 14 and Article 21 of the Constitution. He cited Maneka Gandhi v. Union of India to underscore that procedural fairness is an essential component of substantive rights. The Patta, he contended, constituted prima facie evidence of lawful possession, and its disregard without inquiry was arbitrary.

For the Respondent

The State did not file a written counter-affidavit. The respondents did not appear to contest the procedural irregularities raised, leaving the Court to rely solely on the petitioners’ submissions and the record.

The Court's Analysis

The Court examined the statutory framework under Section 91 of the Rajasthan Land Revenue Act, 1956, which empowers revenue officers to initiate proceedings for recovery of land held without lawful title. However, the Court emphasized that statutory power must be exercised within the bounds of constitutional due process.

"The issuance of a show cause notice does not ipso facto justify coercive action. The right to be heard is not a formality but a substantive safeguard against arbitrary state action."

The Court noted that the petitioners had not only produced a Patta issued in their favor but had also filed a detailed reply addressing the allegations. The Tehsildar’s failure to consider this reply or grant a hearing rendered the proceedings procedurally defective. The Court distinguished this from cases where possession is unchallenged or undocumented, holding that where a document like a Patta exists, the burden shifts to the authority to conduct a fair inquiry before any dispossession.

The Court further held that the principle of audi alteram partem applies with equal force in revenue proceedings, as established in State of U.P. v. Mohammad Noor and K. S. Puttaswamy v. Union of India. The absence of a hearing, even in administrative proceedings, violates the rule of law.

The Verdict

The petitioners succeeded. The Court held that natural justice requires a reasonable opportunity of hearing before any coercive action under Section 91, even where possession is disputed. It directed the Tehsildar to decide the proceedings within four weeks, after considering the petitioners’ reply and affording a hearing, and prohibited any dispossession until final adjudication.

What This Means For Similar Cases

Hearing Is Mandatory Before Dispossession

- Practitioners must now insist on a formal hearing before any revenue officer proceeds to recover land under Section 91, even if the Patta is contested.

- A written reply alone is insufficient; a personal or recorded opportunity to present oral arguments must be granted.

- Failure to provide hearing renders the entire proceeding voidable.

Patta Carries Presumptive Weight

- A Patta issued by revenue authorities is not merely administrative but constitutes prima facie evidence of lawful possession.

- Authorities cannot ignore or dismiss a Patta without conducting a reasoned inquiry.

- In future cases, petitioners may invoke this judgment to challenge summary dispossession orders.

Coercive Action Is Prohibited Pending Adjudication

- Any attempt to evict, fence, or otherwise interfere with possession before final order is illegal.

- Courts will grant interim protection under Article 226 if such actions are threatened.

- This creates a clear procedural shield for landholders in pending revenue disputes.