The Madhya Pradesh High Court has reaffirmed the statutory duty of revenue officers to protect government land, directing strict action against officials found manipulating revenue records. The judgment underscores that public interest litigation under Article 226 can be invoked to correct administrative irregularities in land records, while emphasizing that final determination must follow due process of law.

Background & Facts

The Dispute

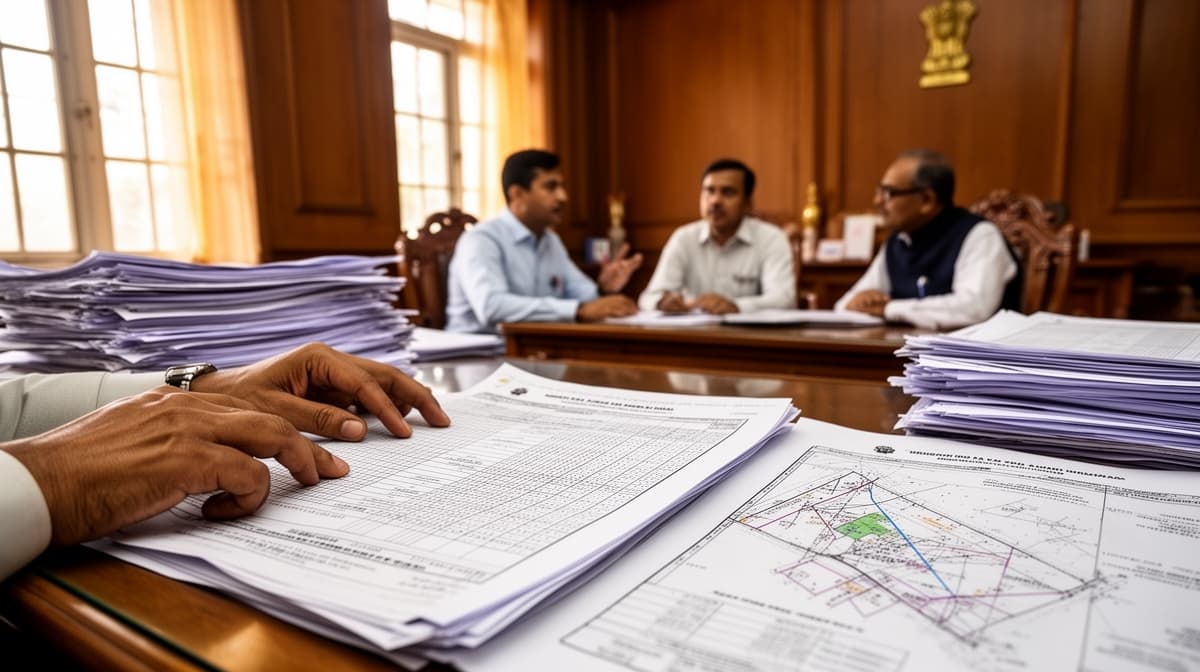

The petitioner, a journalist, filed a public interest litigation under Article 226 of the Constitution of India alleging unauthorized construction and encroachment on government land bearing Survey No. 296/1 in Sheopur district. The petition highlighted discrepancies in revenue records, where the land was incorrectly shown as belonging to the Irrigation Department despite official admissions to the contrary.

Procedural History

The matter progressed through the following stages:

- 2025: Petition filed before the Madhya Pradesh High Court seeking multiple reliefs including demarcation and record rectification

- 23 June 2025: Collector, Sheopur constituted an Enquiry Committee headed by the Deputy Collector

- 4 September 2025: Committee submitted its report detailing irregularities in revenue records

- 3 February 2026: Final hearing before the High Court

Relief Sought

The petitioner sought the following directions:

- Time-bound demarcation and verification of the disputed survey number

- Quashing of illegal entries showing the land as belonging to the Irrigation Department

- Action against officials responsible for record manipulation

- Protection of lawful allottees from dispossession

- General relief in the interest of justice

The Legal Issue

The central question before the Court was whether Article 226 could be invoked to direct administrative authorities to:

- Rectify allegedly manipulated revenue records showing incorrect ownership of government land

- Take disciplinary action against revenue officers found responsible for such manipulation

- Protect government land from unauthorized occupation while ensuring due process for affected parties

Arguments Presented

For the Petitioner

The petitioner contended that:

- The revenue records had been deliberately manipulated to show government land as belonging to the Irrigation Department

- Such manipulation constituted a violation of public trust and amounted to misfeasance in public office

- The Cooperative Housing Society members were facing harassment due to these incorrect records

- Article 226 empowered the High Court to issue directions to correct such administrative irregularities

For the Respondent/State

The State, through its counsel, submitted that:

- The Collector had already constituted an Enquiry Committee which had submitted its report

- The Committee had identified irregularities in the revenue records

- Appropriate action was being taken based on the Committee's findings

- The matter was being handled at the administrative level and required no further judicial intervention

The Court's Analysis

The Court examined the scope of Article 226 in matters concerning government land protection and revenue record rectification. Key observations included:

"It is the duty of revenue officers to protect the government land. If any irregularity or mischief is found in respect of government land or if manipulation is found in revenue records, then strict action be taken against all revenue officers and other responsible persons who were involved into it."

The Court noted that while public interest litigation could be used to highlight administrative irregularities, the final determination of land ownership and disciplinary action must follow due process:

"This Court has not expressed any opinion on merits of the case and Collector, District Sheopur has to proceed on its own merits in accordance with law."

The judgment emphasized three critical principles:

- Administrative accountability: Revenue officers have a statutory duty to maintain accurate land records and protect government land

- Judicial restraint: While Article 226 can be invoked to direct administrative action, courts should avoid usurping the executive's fact-finding role

- Due process: Any action against officials or affected parties must follow established legal procedures

The Verdict

The Court disposed of the petition with the following directions:

- The Collector, Sheopur was directed to ensure necessary follow-up action based on the Enquiry Committee's report within one month

- Strict action was mandated against revenue officers found responsible for record manipulation

- Police action could be initiated against mischievous elements if required

- The Court clarified that no opinion was expressed on the merits of the case, leaving the Collector to proceed in accordance with law

What This Means For Similar Cases

Revenue Officers' Duty Is Non-Negotiable

The judgment reinforces that:

- Revenue officers have an absolute duty to maintain accurate land records and protect government land

- Manipulation of records constitutes misfeasance in public office and may attract both disciplinary and criminal action

- Practitioners should emphasize this statutory duty when challenging irregular land records

PIL Can Trigger Administrative Action

- Public interest litigation under Article 226 can be effectively used to:

- Highlight administrative irregularities in land records

- Direct constitution of enquiry committees

- Ensure time-bound action on committee reports

- However, courts will typically refrain from expressing opinions on merits, leaving final determination to administrative authorities

Procedural Compliance Remains Critical

Practitioners must ensure:

- All administrative remedies are exhausted before approaching courts

- Clear evidence of record manipulation is presented

- Directions sought are limited to administrative action rather than final determination of rights

- Follow-up mechanisms are built into court orders to ensure compliance