The Kerala High Court has clarified that public utilities cannot impose arbitrary procedural barriers to essential services when statutory documentation establishing lawful possession is already furnished. This judgment reinforces the principle that administrative convenience must yield to constitutional rights of access to basic infrastructure.

Background & Facts

The Dispute

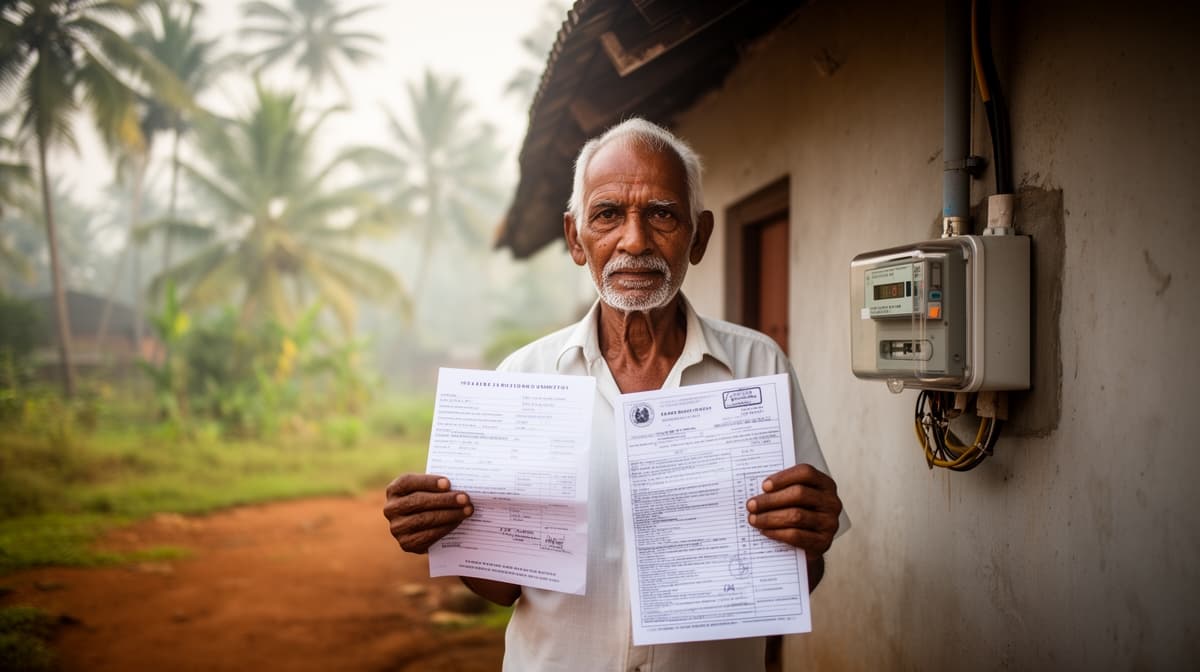

The petitioner, a 65-year-old resident of Idikki District, applied for a fresh electricity connection under the Kerala State Electricity Board. His application was rejected by the sixth respondent on the ground that he had not submitted a No Objection Certificate (NOC) from the Revenue Department. The petitioner had, however, submitted valid land tax receipts and a building certificate issued by the local Grama Panchayat, establishing his lawful occupation and ownership of the premises.

Procedural History

- The petitioner submitted his application for electricity connection in late 2025.

- The sixth respondent, Assistant Engineer of the Electricity Board, rejected the application on 07.01.2026 citing non-production of Revenue NOC.

- The petitioner filed this writ petition under Article 226 of the Constitution, challenging the rejection as arbitrary and contrary to prior judicial precedents.

- The court examined Exhibits P1 (land tax receipt), P2 (building certificate), P3 (rejection order), P4 (W.P(C) No. 10832/2017), and P5 (W.P(C) No. 15586/2024).

Relief Sought

The petitioner sought a direction to the Electricity Board to process his application for electricity connection without insisting on an NOC from the Revenue Department, arguing that the requirement was neither statutory nor reasonable in light of existing documentary proof.

The Legal Issue

The central question was whether the Kerala State Electricity Board can lawfully refuse to process an application for a fresh electricity connection solely on the ground of non-production of a Revenue Department NOC, when the applicant has produced valid land tax receipts and a building certificate from the local panchayat.

Arguments Presented

For the Petitioner

The petitioner relied on W.P(C) No. 10832/2017 and W.P(C) No. 15586/2024, both delivered by this court, which had previously held that the NOC from the Revenue Department is not a mandatory precondition for electricity connection where lawful possession is established through other documents. He argued that the rejection was arbitrary, violative of Article 14, and imposed an unreasonable burden on citizens seeking essential services.

For the Respondent

The respondents did not file a detailed counter-affidavit. The state’s representative conceded during hearing that the requirement of NOC was an internal procedural guideline, not mandated by any statute or rule. No statutory provision was cited to justify the denial.

The Court's Analysis

The Court examined the nature of the documents submitted by the petitioner and compared them with its own prior rulings. It noted that the land tax receipt (Exhibit P1) and the building certificate (Exhibit P2) are official, verifiable documents issued by statutorily recognized local authorities - the Village Officer and the Grama Panchayat. These documents, the Court held, are sufficient to establish lawful occupation and construction.

"The requirement of an NOC from the Revenue Department is not a statutory precondition for the grant of an electricity connection. Where the applicant has produced documents establishing lawful possession, the Electricity Board cannot impose additional, non-statutory conditions."

The Court emphasized that administrative convenience cannot override constitutional rights to access basic utilities. It further observed that the prior judgments in W.P(C) No. 10832/2017 and W.P(C) No. 15586/2024 were directly on point and had not been overruled or distinguished. The refusal to follow these precedents amounted to inconsistent application of law, which is impermissible.

The Court also clarified that its direction does not preclude the Revenue Department from initiating proceedings under revenue laws if there is evidence of unauthorized construction or land use. The judgment is confined to the process of electricity connection, not the underlying land title.

The Verdict

The petitioner succeeded. The Court held that the Electricity Board cannot deny a fresh electricity connection solely due to absence of a Revenue NOC when valid land and building documents are produced. The sixth respondent was directed to process the application on its merits without insisting on the NOC.

What This Means For Similar Cases

Administrative Conditions Must Be Statutorily Grounded

- Practitioners can now challenge any utility’s requirement for an NOC, clearance, or certificate that lacks statutory backing.

- Where documents from local bodies (panchayats, municipalities) establish lawful possession, such documents must be accepted as sufficient.

- Denial of essential services on non-statutory grounds invites writ jurisdiction under Article 226.

Precedents Bind Subsequent Decisions

- Courts will enforce consistency in administrative adjudication.

- If a High Court has previously ruled against a procedural condition, subsequent refusals based on the same ground are prima facie arbitrary.

- Public authorities must either amend rules to formalize requirements or cease enforcing them.

Access to Electricity Is a Constitutional Imperative

- Access to electricity is now recognized as integral to the right to life under Article 21, especially for elderly and marginalized citizens.

- Denial of connection on technicalities, without substantive grounds, violates the principle of dignified living.

- Legal aid clinics and public interest litigants should use this judgment to challenge similar denials across Kerala and other states with analogous practices.