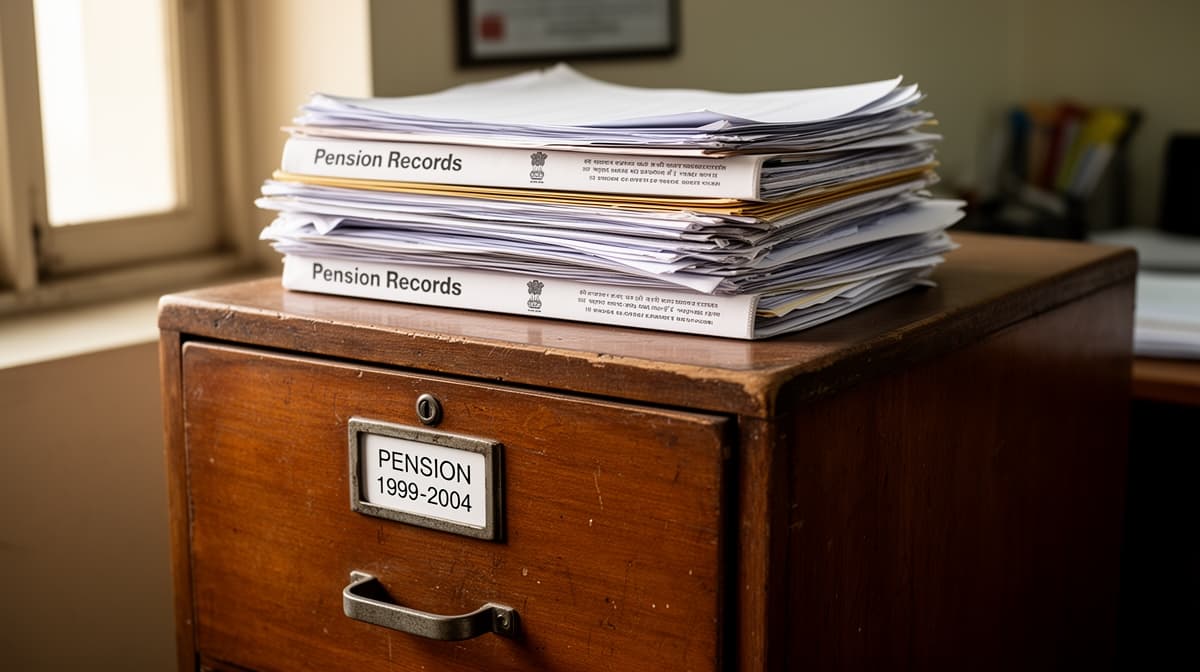

Permanent Parole Eligibility | Life Sentence Without Death Penalty Entitles to Release After 12 Years : High Court of Judicature for Rajasthan

Rajasthan High Court holds that prisoners serving life sentences without death penalty are eligible for permanent parole after 12 years under Rule 9 proviso, rejecting arbitrary rejections by parole committees.