The Madras High Court has reinforced the principles of natural justice in GST proceedings, holding that mere uploading of notices on the GST portal does not constitute effective service when the assessee remains unaware. The judgment mandates that authorities must explore alternative modes of service under Section 169 of the Central Goods and Services Tax Act, 2017 before passing ex parte orders, ensuring procedural fairness in tax assessments.

Background & Facts

The Dispute

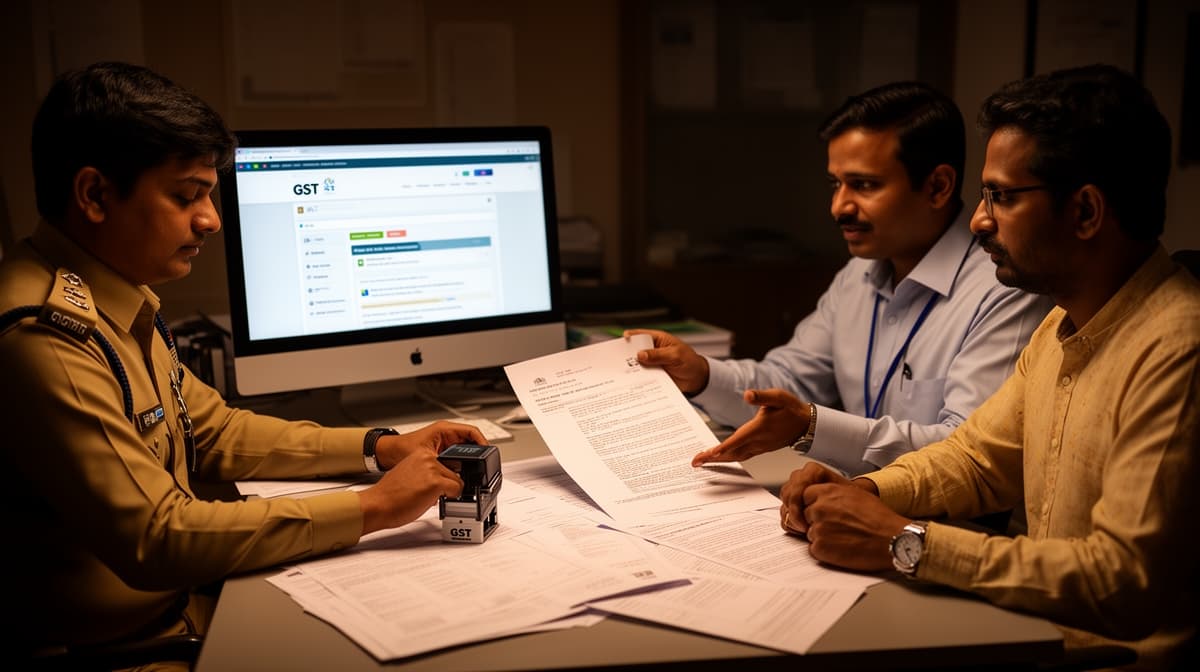

The petitioner, Tvl. Niyas Hardwares & Paints, a proprietorship firm in Ramanathapuram, challenged an assessment order dated 25.02.2025 passed by the GST authorities. The dispute arose when the petitioner failed to respond to show cause notices uploaded on the GST portal, leading to an ex parte order confirming tax demands without affording a personal hearing.

Procedural History

The case reached the Madras High Court through a writ petition under Article 226 of the Constitution of India, seeking quashing of the impugned order. The matter was taken up for disposal at the admission stage by consent of parties.

Relief Sought

The petitioner sought:

- Quashing of the assessment order dated 25.02.2025

- Opportunity to present their case before the assessing authority

- Conditional remand subject to payment of 25% of the disputed tax amount

The Legal Issue

The central question was whether the GST authorities complied with the principles of natural justice by ensuring effective service of notices and providing a personal hearing before passing an ex parte assessment order under the CGST Act, 2017.

Arguments Presented

For the Petitioner

The petitioner contended that:

- They were unaware of the show cause notices uploaded on the GST portal

- No personal hearing was granted before passing the impugned order

- The authorities failed to explore alternative modes of service under Section 169 of the CGST Act

- Offered to pay 25% of the disputed tax amount as a condition for remand

For the Respondent

The Additional Government Pleader admitted that:

- Notices were uploaded on the GST portal but no personal hearing was provided

- The petitioner failed to respond to the notices

- Agreed to remand the matter subject to payment of 25% of the disputed tax

The Court's Analysis

The Court examined the procedural requirements under the CGST Act and the principles of natural justice. Key observations included:

"Merely passing an ex parte order by fulfilling the empty formalities will not serve any useful purpose and the same will only pave way for multiplicity of litigations, not only wasting the time of the Officer concerned, but also the precious time of the Appellate Authority/Tribunal and this Court as well."

The Court held that:

- Uploading notices on the GST portal alone does not constitute effective service when the assessee remains unaware

- Authorities must explore alternative modes of service under Section 169(1) of the CGST Act, such as Registered Post with Acknowledgement Due (RPAD), to ensure compliance with natural justice

- Personal hearing is a mandatory requirement before passing adverse orders, failing which the assessment is vitiated

The judgment emphasized that procedural compliance is not a mere formality but a safeguard against arbitrary actions:

"When there is no response from the tax payer to the notice sent through a particular mode, the Officer who is issuing notices should strictly explore the possibilities of sending notices through some other mode as prescribed in Section 169(1) of the Act, preferably by way of RPAD, which would ultimately achieve the object of the GST Act."

The Verdict

The Court allowed the writ petition and set aside the impugned order dated 25.02.2025, remanding the matter to the assessing authority with the following directions:

- The petitioner must pay 25% of the disputed tax amount within four weeks

- The petitioner must file their reply/objections within three weeks of payment

- The authorities must issue a 14-day notice for personal hearing and pass a fresh order on merits after hearing the petitioner

What This Means For Similar Cases

Effective Service of Notices Is Non-Negotiable

The judgment establishes that GST authorities cannot rely solely on portal uploads for service of notices. Practitioners should:

- Argue for quashing of ex parte orders where service was ineffective

- Demand proof of alternative modes of service under Section 169 CGST Act

- Highlight the mandatory nature of personal hearings before adverse orders

Procedural Compliance Trumps Substantive Claims

- Burden on authorities: The Court placed the onus on GST officers to ensure effective service, failing which orders are liable to be set aside

- Conditional remand: Assessees can seek remand by offering partial payment of disputed amounts, as seen in this case

- Multiplicity of litigation: The judgment discourages mechanical orders that lead to repeated appeals, emphasizing quality adjudication

Actionable Takeaways for Practitioners

- For assessees: Challenge ex parte orders where notices were not effectively served or personal hearing was denied

- For authorities: Document efforts to serve notices through multiple modes under Section 169 CGST Act

- For appellate forums: Scrutinize procedural compliance before upholding assessment orders

- For tax consultants: Advise clients to monitor GST portals regularly and respond promptly to notices to avoid ex parte actions