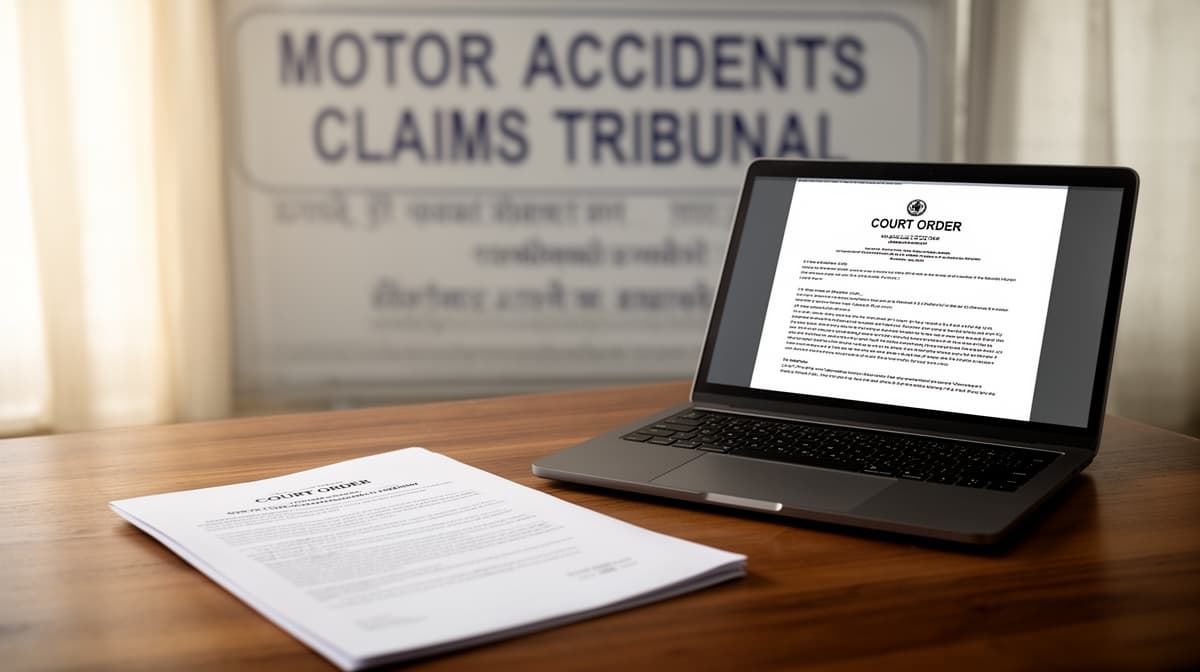

Stay of Execution | Deposit Condition Must Reflect Financial Capacity : Andhra Pradesh High Court

Andhra Pradesh High Court reduces stay deposit from 50% to ₹2 lakh in civil appeal, holding that financial capacity must inform conditioning of execution stays.