The Gujarat High Court has clarified a critical principle in motor accident compensation cases: when a claimant’s income is not substantiated by documentary evidence, tribunals must rely on the prevailing minimum wage rates, not speculative or arbitrary notional figures. This ruling reinforces statutory compliance and ensures equitable redress for victims of road accidents, particularly those in informal employment.

Background & Facts

The Dispute

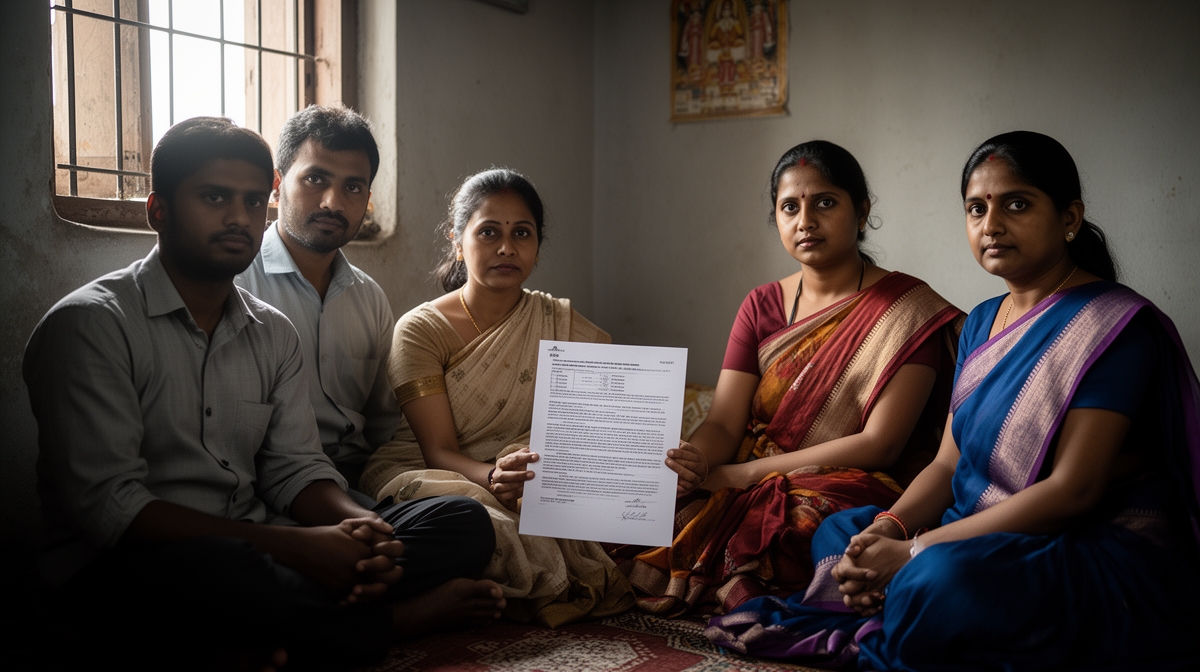

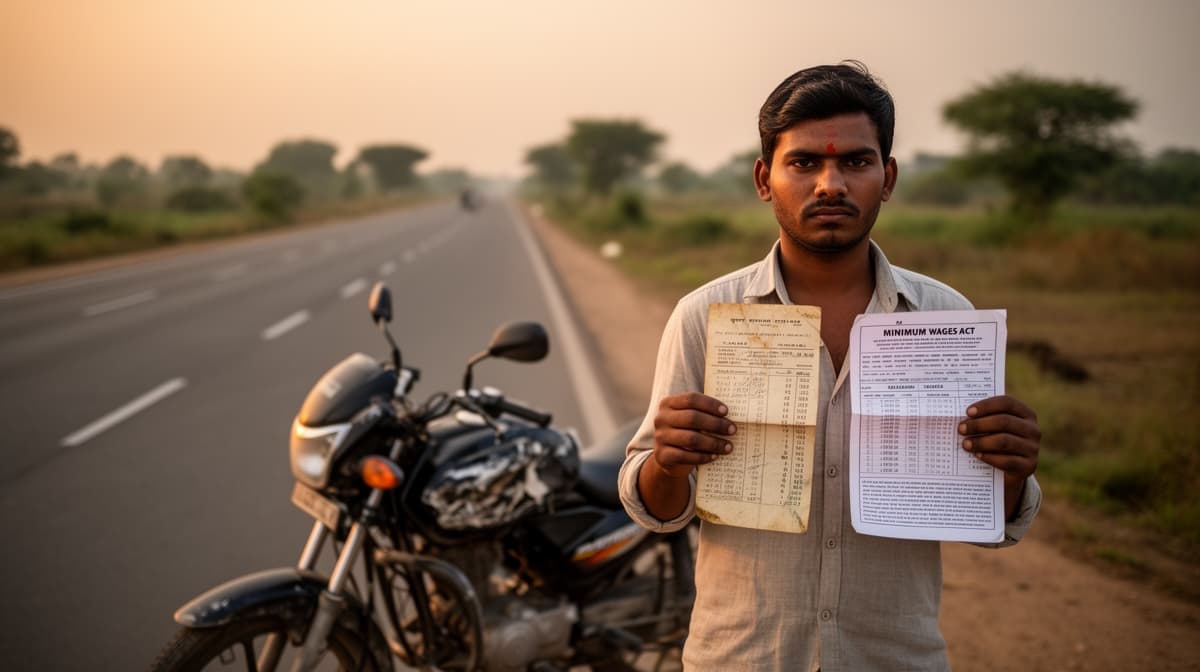

The appellant, Jayeshkumar Sirilbhai Parmar, was injured on 4 October 2019 when a Vitkos minibus, driven negligently, collided with a motorcycle he was standing beside on the Ahmedabad-Vadodara National Highway. He sustained permanent disability and filed a claim petition before the Motor Accident Claims Tribunal (MACT), seeking compensation for medical expenses, loss of income, pain and suffering, and future economic loss.

Procedural History

- October 2019: Accident occurred on national highway near Mogar Bridge

- 2019: MAC Petition No.1094 of 2019 filed before MACT, Nadiad

- February 2023: Tribunal awarded compensation of Rs.5,46,730/-

- 2025: Appeal filed before Gujarat High Court under Section 173 of the Motor Vehicles Act, 1988

Relief Sought

The appellant sought enhancement of compensation, particularly on the grounds that the Tribunal erred in assessing his monthly income at Rs.4,500/- on a notional basis, failed to account for future prospect, and undercompensated for loss of earnings and pain and suffering.

The Legal Issue

The central question was whether the Motor Accident Claims Tribunal is bound to use the prevailing minimum wage rate as the baseline for income assessment when the claimant’s actual earnings are unproven, and whether a 40% addition for future prospect is mandatory in cases involving permanent disability.

Arguments Presented

For the Appellant

The appellant’s counsel argued that the Tribunal’s reliance on a notional income of Rs.4,500/- was legally untenable. He cited Govind Yadav v. National Insurance Co. Ltd. (2012) to assert that in the absence of proof of income, tribunals must adopt the minimum wage rate under the Minimum Wages Act, 1948. He further contended that the Tribunal’s failure to apply a 40% future prospect addition to the income, as mandated by Smt. Sarla Verma v. Delhi Transport Corporation, constituted a material error.

For the Respondent

The Insurance Company’s counsel defended the Tribunal’s award, asserting that the income assessment was reasonable given the claimant’s occupation as a musician and casual worker. He argued that the Tribunal had properly applied the multiplier of 16 and that the compensation for pain and suffering was adequate. He also maintained that the 80:20 negligence apportionment was consistent with findings in a related case.

The Court's Analysis

The Court undertook a rigorous review of the Tribunal’s methodology, emphasizing statutory compliance and binding precedents. It noted that the claimant had submitted an affidavit and supporting documents, including a police complaint and charge sheet, but no formal wage slips or income tax returns. In such circumstances, the Court held that the Tribunal’s use of Rs.4,500/- as a notional figure was arbitrary and contrary to the Supreme Court’s directive in Govind Yadav.

"In the absence of any proof of income, the Tribunal is bound to consider the prevailing rate of minimum wages. Notional figures, however convenient, cannot substitute statutory benchmarks."

The Court further held that the claimant, aged 35 at the time of accident and suffering 55% permanent disability, was entitled to a 40% addition for future prospect, as per Sarla Verma. The Tribunal’s omission of this addition was a clear error. The Court recalculated the monthly income at Rs.8,200/-, the minimum wage applicable in Gujarat for unskilled labor in 2019, and applied the 40% uplift to arrive at Rs.11,480/- per month.

The Court also affirmed the 80:20 negligence ratio established in a parallel case, noting that the claimant was not required to implead the 20% negligent party to benefit from the apportionment. It further relied on Nagappa v. Gurudayal Singh to hold that compensation may exceed the amount claimed if the evidence supports a higher award.

The Verdict

The appellant succeeded in part. The Gujarat High Court held that minimum wage rates must govern income assessment in the absence of proof, and a 40% future prospect addition is mandatory for permanent disability. The compensation was enhanced by Rs.5,98,550/-, bringing the total to Rs.11,45,280/- after applying the 80% liability ratio. The Insurance Company was directed to deposit the enhanced amount within four weeks.

What This Means For Similar Cases

Minimum Wage Is the Floor, Not a Suggestion

- Practitioners must now insist that tribunals use the latest minimum wage rate for the claimant’s occupation and region, not arbitrary figures

- Failure to do so renders the award liable to be set aside on appeal

- Evidence of informal employment (e.g., affidavits, employer statements) should be submitted to corroborate wage claims

Future Prospect Is Not Discretionary

- For permanent disabilities, 40% future prospect must be added to the recalculated income unless the claimant is over 55 or has no earning capacity

- Tribunals must explicitly state their reasoning if they deviate from this norm

- This applies even if the claimant is self-employed or works in the informal sector

Compensation Can Exceed Claimed Amount

- Claimants need not fear that seeking Rs.5 lakh will cap their award at that figure

- Courts may award more if evidence supports higher loss, per Nagappa

- Advocates should frame claims conservatively but argue for enhancement based on statutory benchmarks