The Bombay High Court has reaffirmed that when an individual acts as a custodian of funds collected on behalf of a co-operative society for repayment to a financial institution, and deliberately fails to deposit those funds despite issuing receipts, the act constitutes criminal breach of trust under Section 406 IPC. This judgment clarifies the legal boundaries of fiduciary responsibility in housing finance structures involving member contributions.

Background & Facts

The Dispute

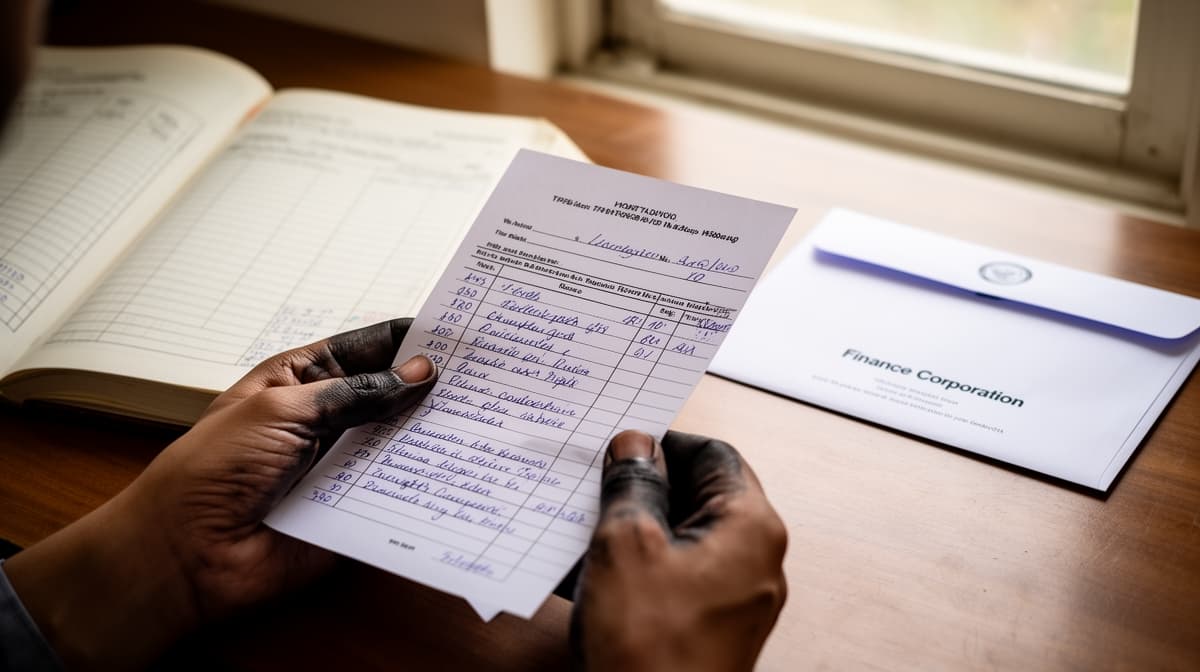

The dispute arose from the operations of "Sanjog Sahakari Gruh Nirman Sanstha", a housing co-operative society with 46 members. The society obtained a loan from the Maharashtra State Co-operative Housing Finance Corporation to construct houses for its members. Each member paid an initial installment to the accused, Ramesh Bangad, who was the Chairman of the society. The members were then required to repay the loan in monthly installments, which they paid directly to the accused. The accused issued receipts for these payments but failed to deposit the collected amounts with the Finance Corporation.

Procedural History

- 1997: Complaint filed by member Vishwanath Kale alleging misappropriation of Rs. 11,444 and other installments.

- 1998: Trial Court framed charges under Sections 420 and 406 IPC.

- 2002: Trial Court acquitted accused of cheating under Section 420 IPC but convicted him under Section 406 IPC for criminal breach of trust.

- 2002: First Appellate Court confirmed conviction under Section 406 IPC but reduced sentence from rigorous to simple imprisonment.

- 2024: Revision application filed before Bombay High Court challenging the conviction.

Relief Sought

The accused sought quashing of the conviction under Section 406 IPC, arguing that the audit report was unreliable, that he was not the legal debtor, and that the Finance Corporation’s claim was against the society, not him personally.

The Legal Issue

The central question was whether Section 406 IPC applies when an individual, acting as a custodian of funds collected from society members, receives payments intended for deposit with a financial institution but retains them for personal use, despite issuing formal receipts.

Arguments Presented

For the Petitioner

Learned counsel argued that the accused was merely an administrative officer of the society and not personally liable for repayment. He contended that the audit report by PW7 was speculative, as the witness lacked direct knowledge of transactions. He emphasized that receipts issued were acknowledgments of payment, not evidence of personal trust, and that the Finance Corporation’s claim was against the society, not the accused. He relied on State of Maharashtra v. Suresh to argue that mere failure to remit funds does not automatically constitute criminal breach of trust without proof of dishonest intent.

For the Respondent/State

The State contended that the accused, by accepting payments and issuing receipts, assumed a fiduciary duty to deposit the funds with the Finance Corporation. The prosecution highlighted that the accused had exclusive control over the collected sums, and the audit report confirmed a discrepancy of over Rs. 9 lakh. The State cited K. R. Srinivasan v. State of Tamil Nadu to argue that entrustment of property through receipt issuance satisfies the requirement of "entrustment" under Section 406 IPC.

The Court's Analysis

The Court examined the nature of the accused’s role and the legal implications of issuing receipts. It held that the issuance of receipts under the accused’s signature constituted clear acknowledgment of receipt and entrustment of funds. The Court emphasized that entrustment under Section 406 IPC does not require a formal contract but arises from factual circumstances where one party places trust in another to handle funds for a specific purpose.

"By admitting issuance of receipts, which is brought by way of suggestion to the witnesses, entrustment of money is indirectly admitted."

The Court rejected the petitioner’s argument that the society alone was liable, noting that the accused was not merely a conduit but the actual recipient and custodian of the funds. The audit report by PW7, an independent expert, corroborated the discrepancy between amounts collected and amounts deposited. The Court found no perversity in the lower courts’ appreciation of evidence, stating that the burden of explaining the absence of deposit shifted to the accused, who offered no credible explanation.

The Court further held that the accused’s retention of funds, despite repeated notices from the Finance Corporation, demonstrated dishonest intent inherent in the offense. The fact that the accused was married to the builder and potentially benefited from the funds did not negate the legal conclusion that he was a fiduciary custodian.

The Verdict

The revision was dismissed. The Court upheld the conviction under Section 406 IPC, holding that the accused’s receipt and retention of society members’ loan installments, without depositing them with the Finance Corporation, constituted criminal breach of trust. The sentence of one month’s simple imprisonment was confirmed.

What This Means For Similar Cases

Custodianship Implies Legal Liability

- Practitioners must now treat any individual who collects and issues receipts for funds meant for third-party deposit as a fiduciary under Section 406 IPC.

- Receipts are not mere acknowledgments - they are evidence of entrustment.

- Failure to remit funds, even without direct proof of personal enrichment, suffices for conviction if intent to defraud is inferable.

Audit Reports Are Admissible as Corroborative Evidence

- Independent audit reports by statutory auditors are admissible and carry significant weight in proving discrepancies.

- Defense arguments that auditors lack "first-hand knowledge" will fail if the report is based on verifiable bank and ledger records.

- Courts will not require direct eyewitness testimony when documentary and expert evidence align.

Society Structure Does Not Shield Individuals

- Corporate or societal structure does not insulate individuals from personal criminal liability if they act as de facto custodians.

- Officers of co-operative societies who handle member payments must maintain strict accounting and remittance protocols.

- Prosecutors may now rely on this precedent to charge individuals in similar housing finance schemes where funds are collected privately but owed to financial institutions.