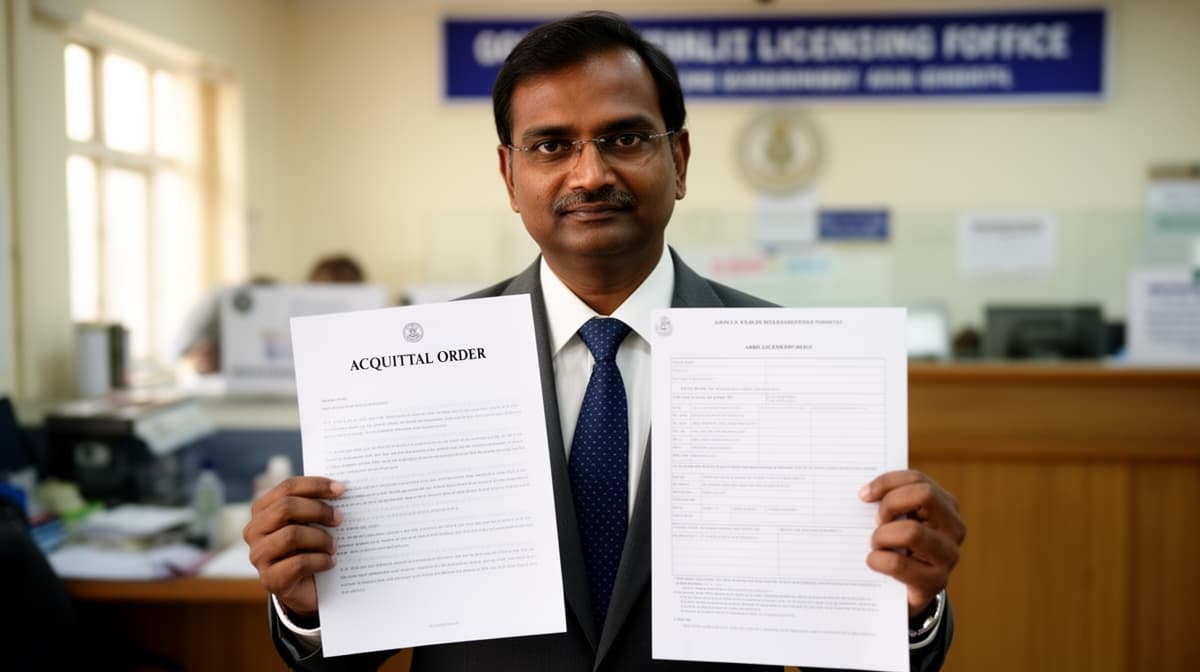

Honorable Acquittal Bars Denial of Fresh Arms License Based on Past Criminal Case : Madhya Pradesh High Court

Madhya Pradesh High Court holds that honorable acquittal in a criminal case cannot be grounds to reject a fresh arms license application, affirming presumption of innocence.