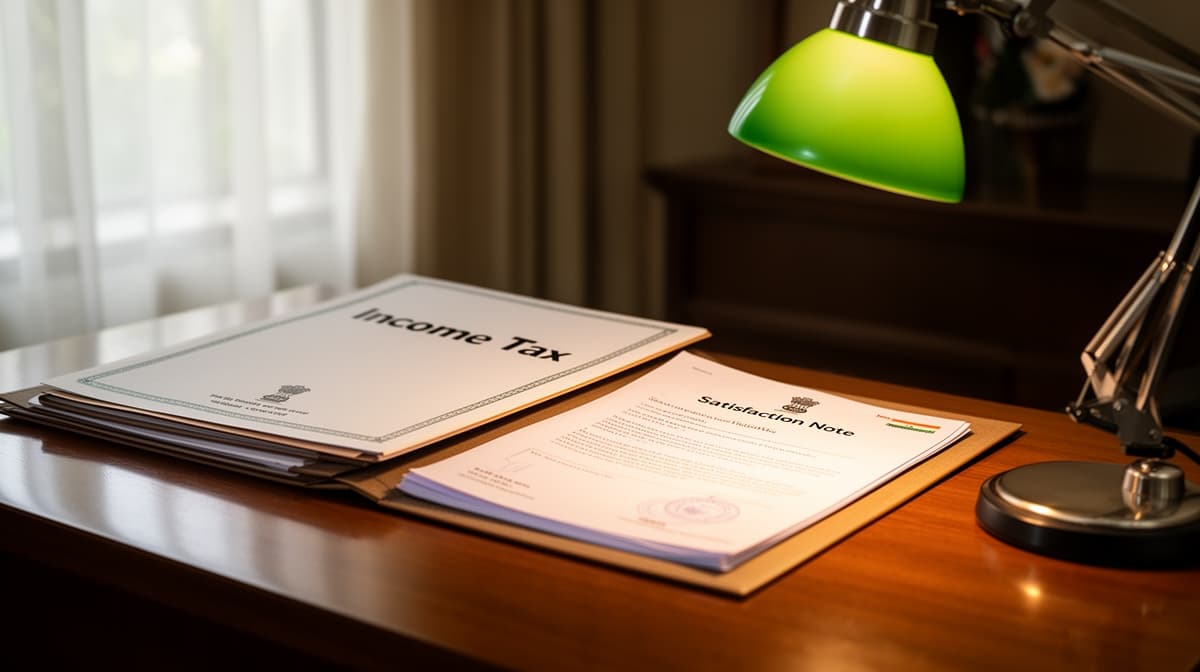

Credit Card Payments Cannot Be Treated as Unexplained Cash Credits Under Section 68 | Limited Scrutiny Context : Income Tax Appellate Tribunal

ITAT Chennai holds that credit card debits cannot be taxed as unexplained cash credits under Section 68; assessment must focus on factual verification within limited scrutiny scope.